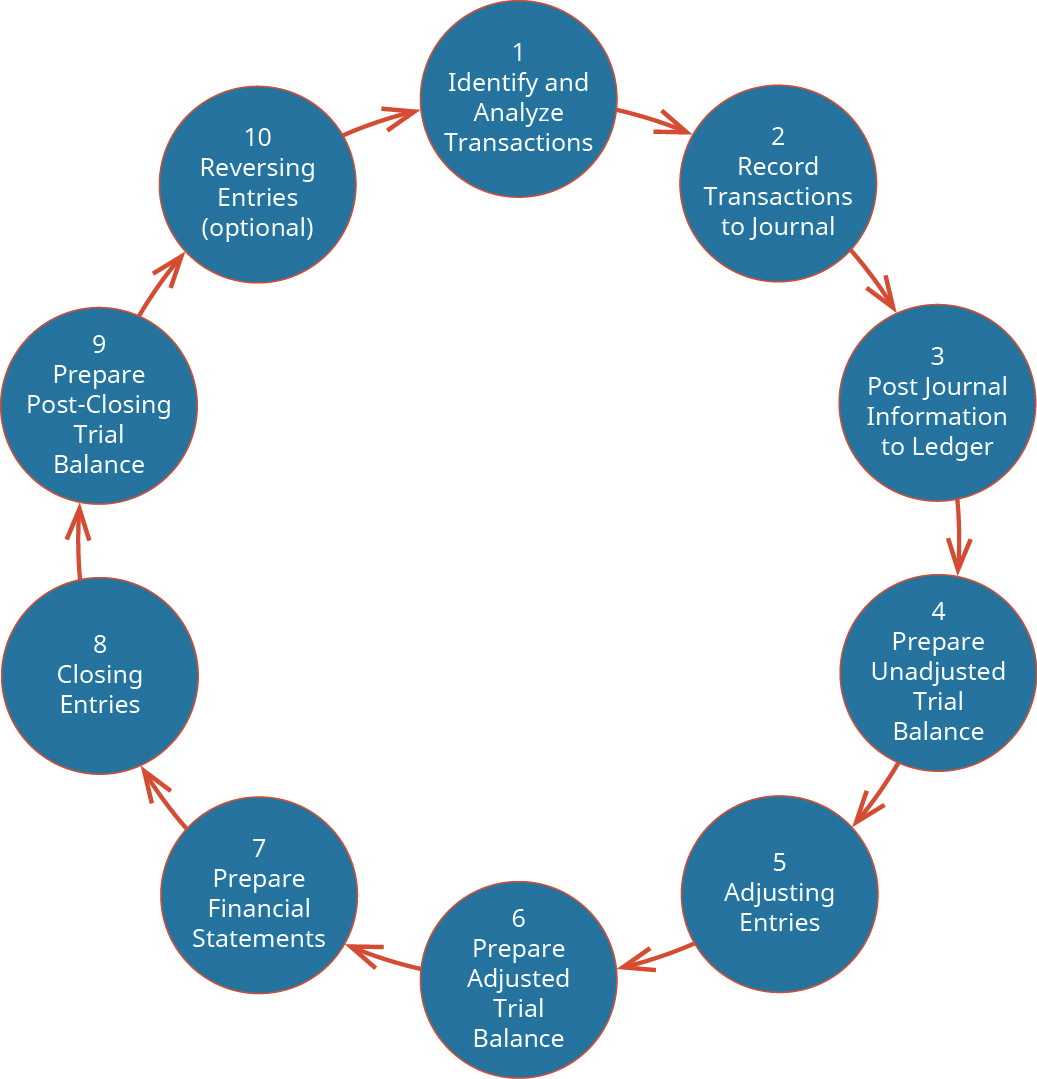

We have gone through the entire accounting cycle for Printing Plus with the steps spread over three chapters. Let’s go through the complete accounting cycle for another company here. The full accounting cycle diagram is presented in (Figure).

We next take a look at a comprehensive example that works through the entire accounting cycle for Clip’em Cliff. Clifford Girard retired from the US Marine Corps after 20 years of active duty. Cliff decides it would be fun to become a barber and open his own shop called “Clip’em Cliff.” He will run the barber shop out of his home for the first couple of months while he identifies a new location for his shop.

Since his Marines career included several years of logistics, he is also going to operate a consulting practice where he will help budding barbers create a barbering practice. He will charge a flat fee or a per hour charge. His consulting practice will be recognized as service revenue and will provide additional revenue while he develops his barbering practice.

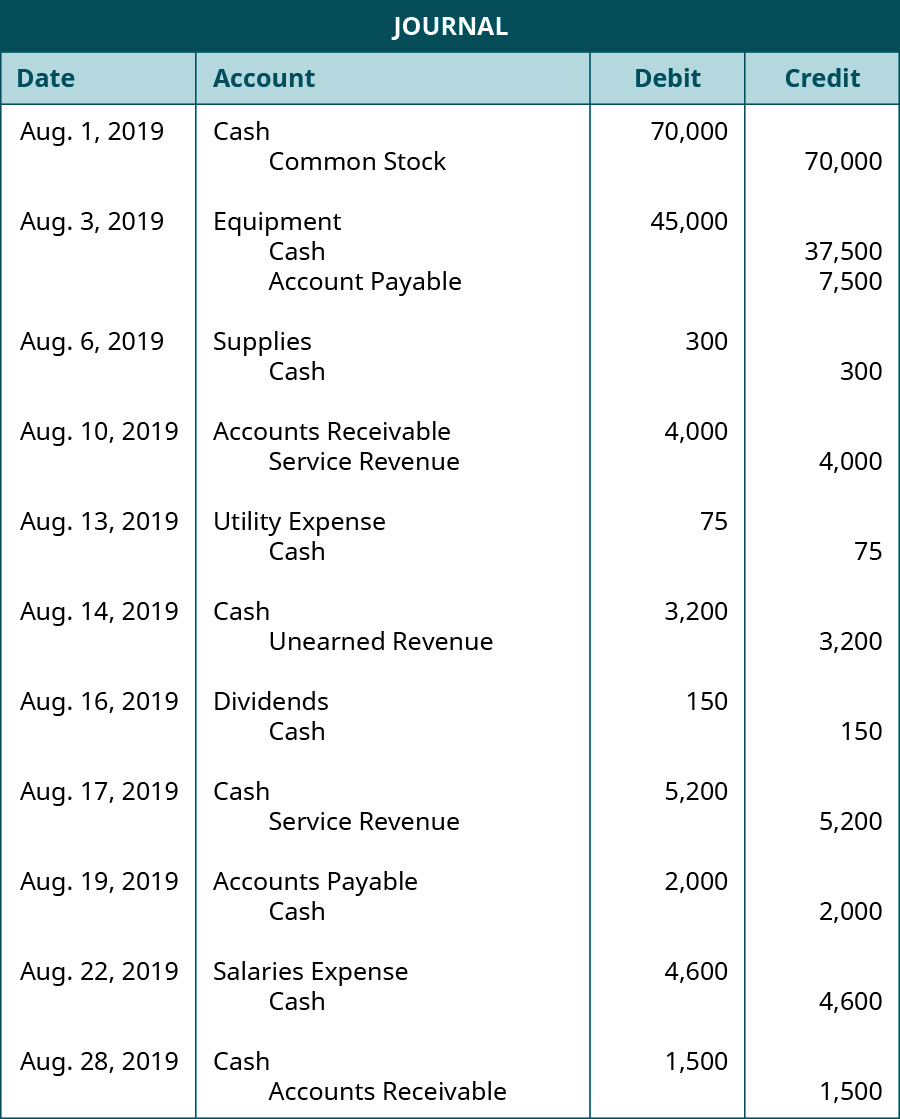

He obtains a barber’s license after the required training and is ready to open his shop on August 1. (Figure) shows his transactions from the first month of business.

| Transactions for August | |

|---|---|

| Date | Transaction |

| Aug. 1 | Cliff issues $70,000 shares of common stock for cash. |

| Aug. 3 | Cliff purchases barbering equipment for $45,000; $37,500 was paid immediately with cash, and the remaining $7,500 was billed to Cliff with payment due in 30 days. He decided to buy used equipment, because he was not sure if he truly wanted to run a barber shop. He assumed that he will replace the used equipment with new equipment within a couple of years. |

| Aug. 6 | Cliff purchases supplies for $300 cash. |

| Aug. 10 | Cliff provides $4,000 in services to a customer who asks to be billed for the services. |

| Aug. 13 | Cliff pays a $75 utility bill with cash. |

| Aug. 14 | Cliff receives $3,200 cash in advance from a customer for services not yet rendered. |

| Aug. 16 | Cliff distributed $150 cash in dividends to stockholders. |

| Aug. 17 | Cliff receives $5,200 cash from a customer for services rendered. |

| Aug. 19 | Cliff paid $2,000 toward the outstanding liability from the August 3 transaction. |

| Aug. 22 | Cliff paid $4,600 cash in salaries expense to employees. |

| Aug. 28 | The customer from the August 10 transaction pays $1,500 cash toward Cliff’s account. |

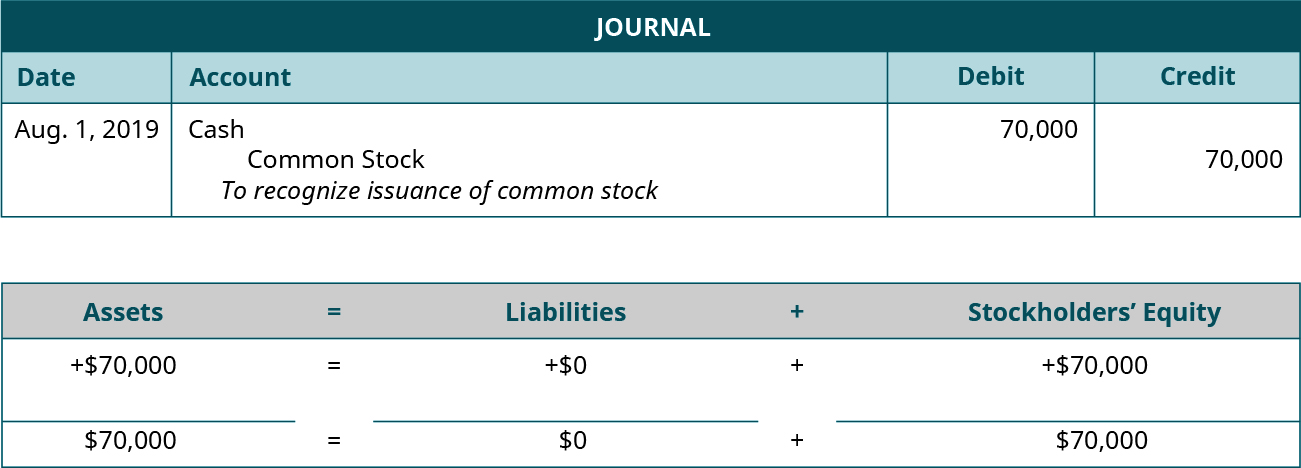

Transaction 1: On August 1, 2019, Cliff issues $70,000 shares of common stock for cash.

Analysis:

- Clip’em Cliff now has more cash. Cash is an asset, which is increasing on the debit side.

- When the company issues stock, this yields a higher common stock figure than before issuance. The common stock account is increasing on the credit side.

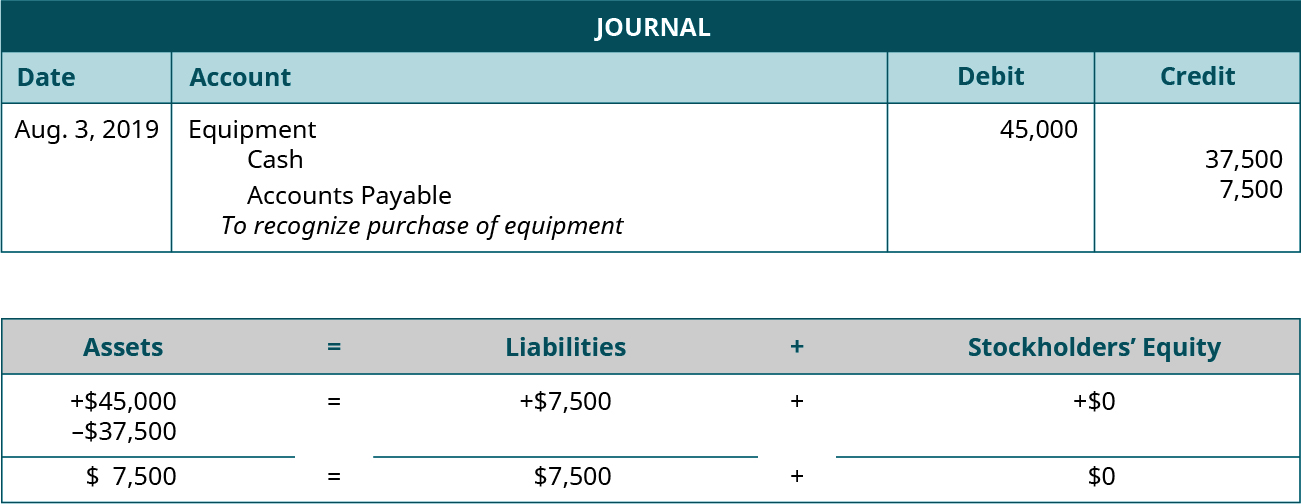

Transaction 2: On August 3, 2019, Cliff purchases barbering equipment for $45,000; $37,500 was paid immediately with cash, and the remaining $7,500 was billed to Cliff with payment due in 30 days.

Analysis:

- Clip’em Cliff now has more equipment than before. Equipment is an asset, which is increasing on the debit side for $45,000.

- Cash is used to pay for $37,500. Cash is an asset, decreasing on the credit side.

- Cliff asked to be billed, which means he did not pay cash immediately for $7,500 of the equipment. Accounts Payable is used to signal this short-term liability. Accounts payable is increasing on the credit side.

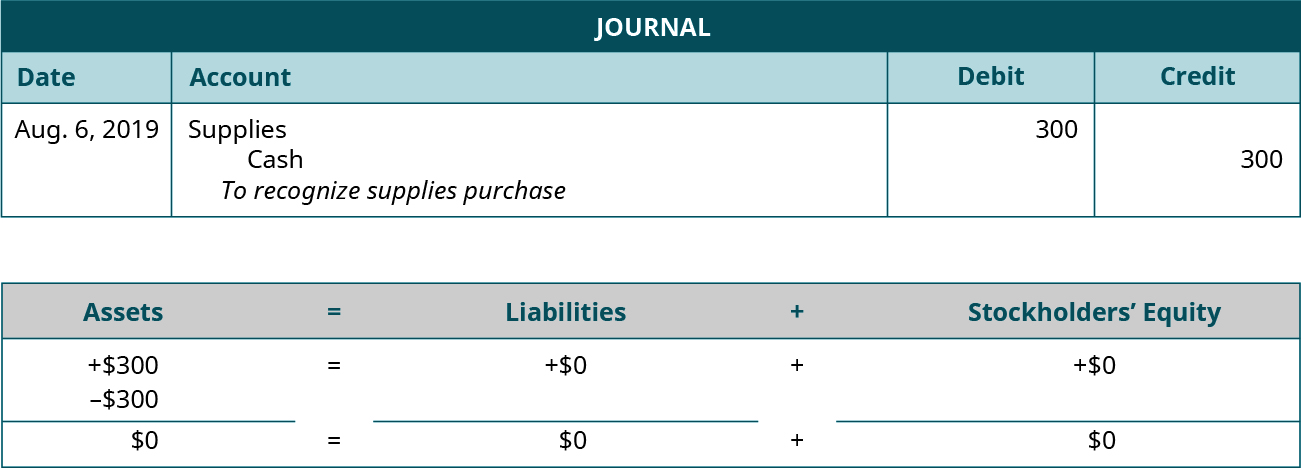

Transaction 3: On August 6, 2019, Cliff purchases supplies for $300 cash.

Analysis:

- Clip’em Cliff now has less cash. Cash is an asset, which is decreasing on the credit side.

- Supplies, an asset account, is increasing on the debit side.

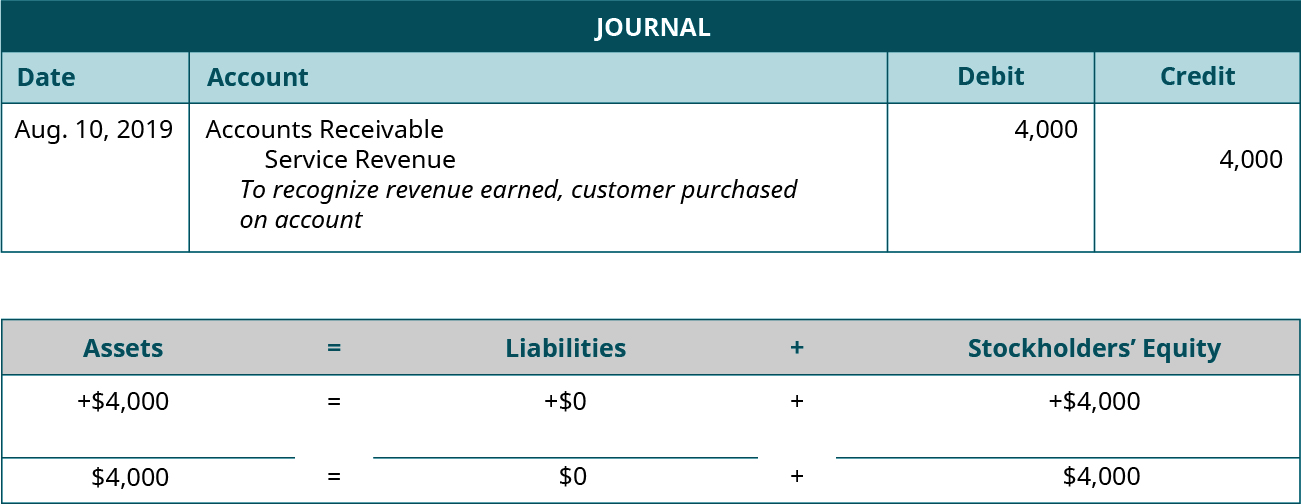

Transaction 4: On August 10, 2019, provides $4,000 in services to a customer who asks to be billed for the services.

Analysis:

- Clip’em Cliff provided service, thus earning revenue. Revenue impacts equity, and increases on the credit side.

- The customer did not pay immediately for the service and owes Cliff payment. This is an Accounts Receivable for Cliff. Accounts Receivable is an asset that is increasing on the debit side.

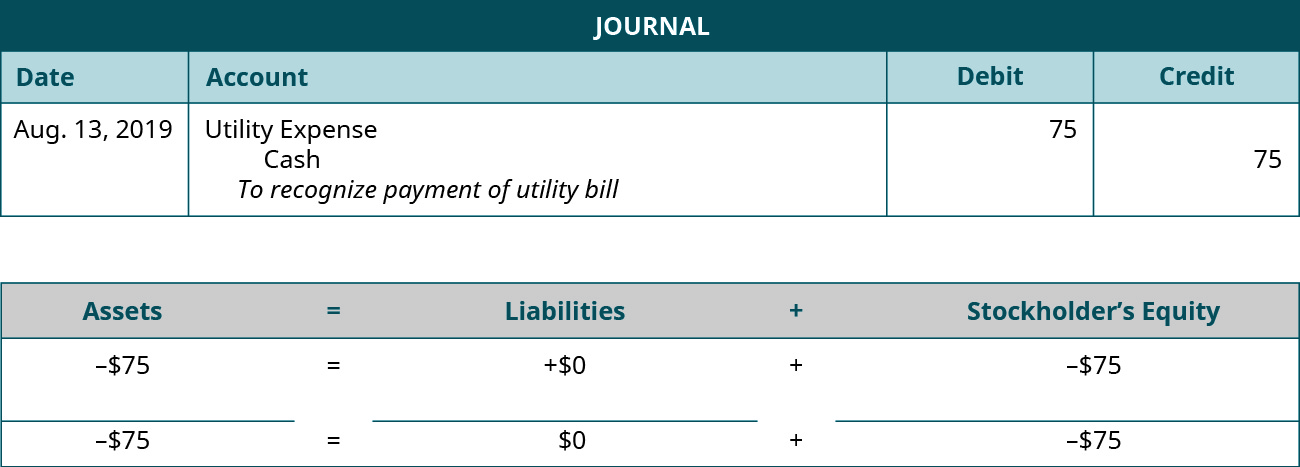

Transaction 5: On August 13, 2019, Cliff pays a $75 utility bill with cash.

Analysis:

- Clip’em Cliff now has less cash than before. Cash is an asset that is decreasing on the credit side.

- Utility payments are billed expenses. Utility Expense negatively impacts equity, and increases on the debit side.

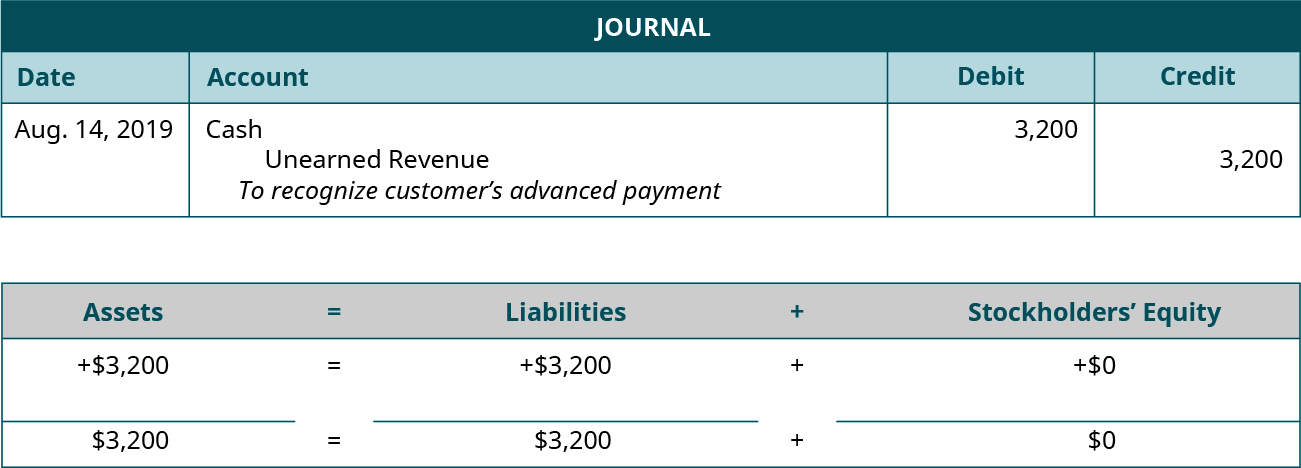

Transaction 6: On August 14, 2019, Cliff receives $3,200 cash in advance from a customer for services to be rendered.

Analysis:

- Clip’em Cliff now has more cash. Cash is an asset, which is increasing on the debit side.

- The customer has not yet received services but already paid the company. This means the company owes the customer the service. This creates a liability to the customer, and revenue cannot yet be recognized. Unearned Revenue is the liability account, which is increasing on the credit side.

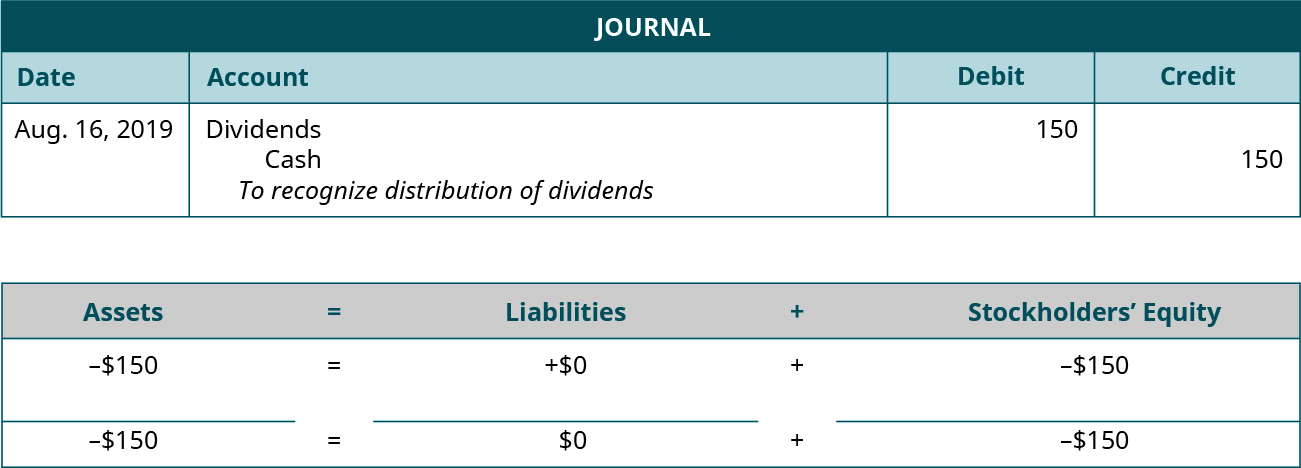

Transaction 7: On August 16, 2019, Cliff distributed $150 cash in dividends to stockholders.

Analysis:

- Clip’em Cliff now has less cash. Cash is an asset, which is decreasing on the credit side.

- When the company pays out dividends, this decreases equity and increases the dividends account. Dividends increases on the debit side.

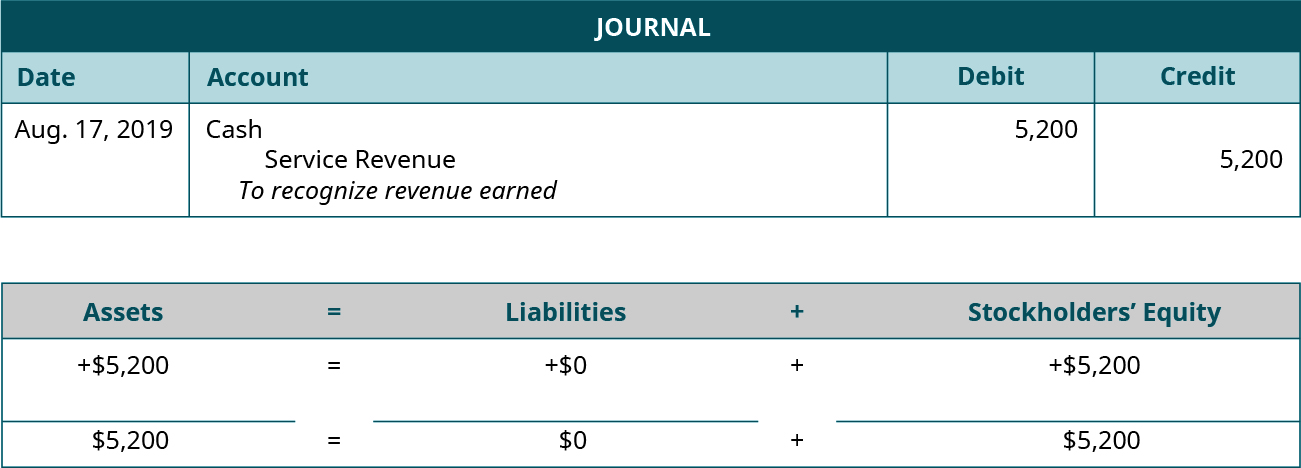

Transaction 8: On August 17, 2019, Cliff receives $5,200 cash from a customer for services rendered.

Analysis:

- Clip’em Cliff now has more cash than before. Cash is an asset, which is increasing on the debit side.

- Service was provided, which means revenue can be recognized. Service Revenue increases equity. Service Revenue is increasing on the credit side.

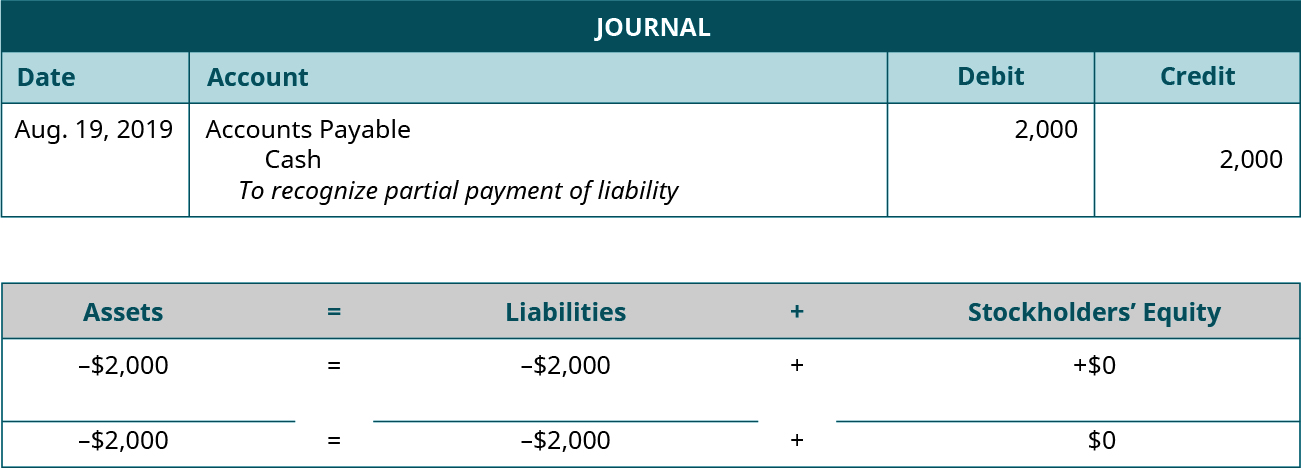

Transaction 9: On August 19, 2019, Cliff paid $2,000 toward the outstanding liability from the August 3 transaction.

Analysis:

- Clip’em Cliff now has less cash. Cash is an asset, which is decreasing on the credit side.

- Accounts Payable is a liability account, decreasing on the debit side.

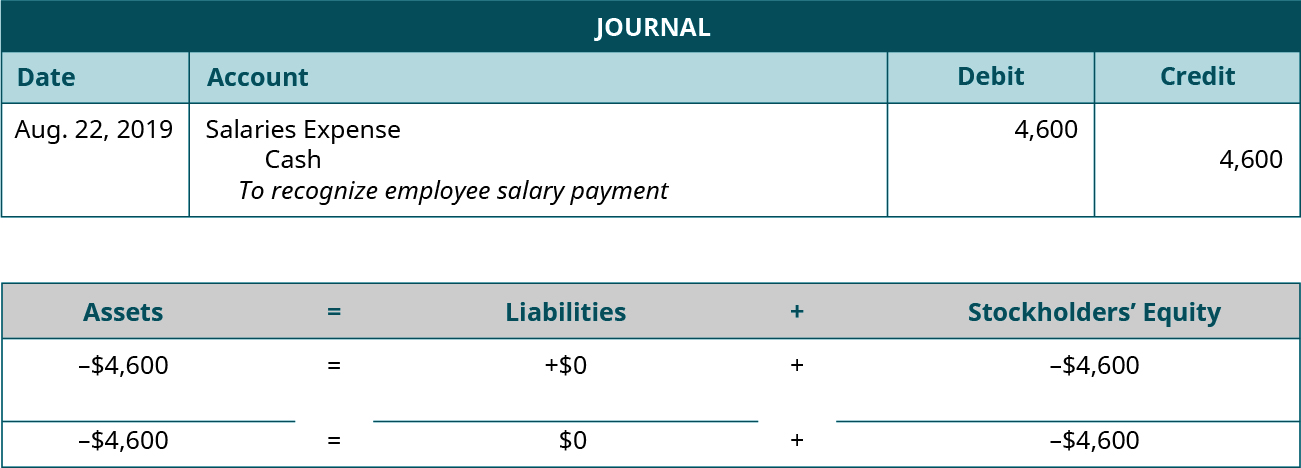

Transaction 10: On August 22, 2019, Cliff paid $4,600 cash in salaries expense to employees.

Analysis:

- Clip’em Cliff now has less cash. Cash is an asset, which is decreasing on the credit side.

- When the company pays salaries, this is an expense to the business. Salaries Expense reduces equity by increasing on the debit side.

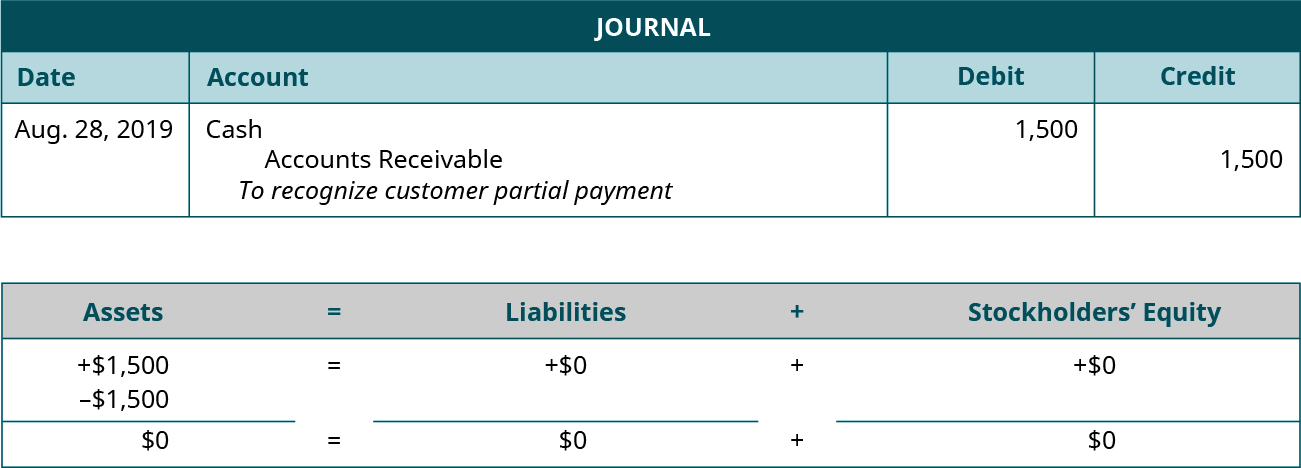

Transaction 11: On August 28, 2019, the customer from the August 10 transaction pays $1,500 cash toward Cliff’s account.

Analysis:

- The customer made a partial payment on their outstanding account. This reduces Accounts Receivable. Accounts Receivable is an asset account decreasing on the credit side.

- Cash is an asset, increasing on the debit side.

The complete journal for August is presented in (Figure).

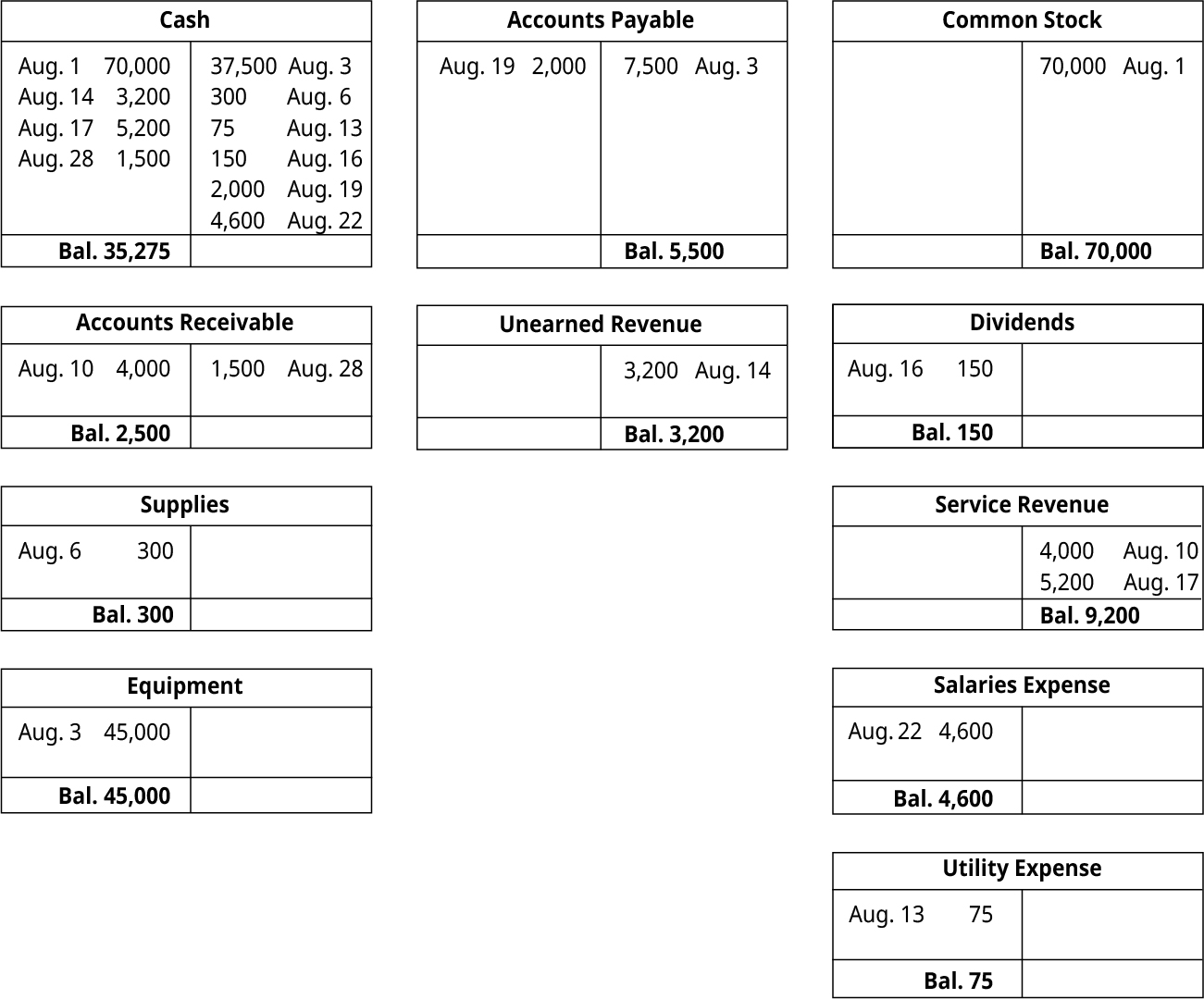

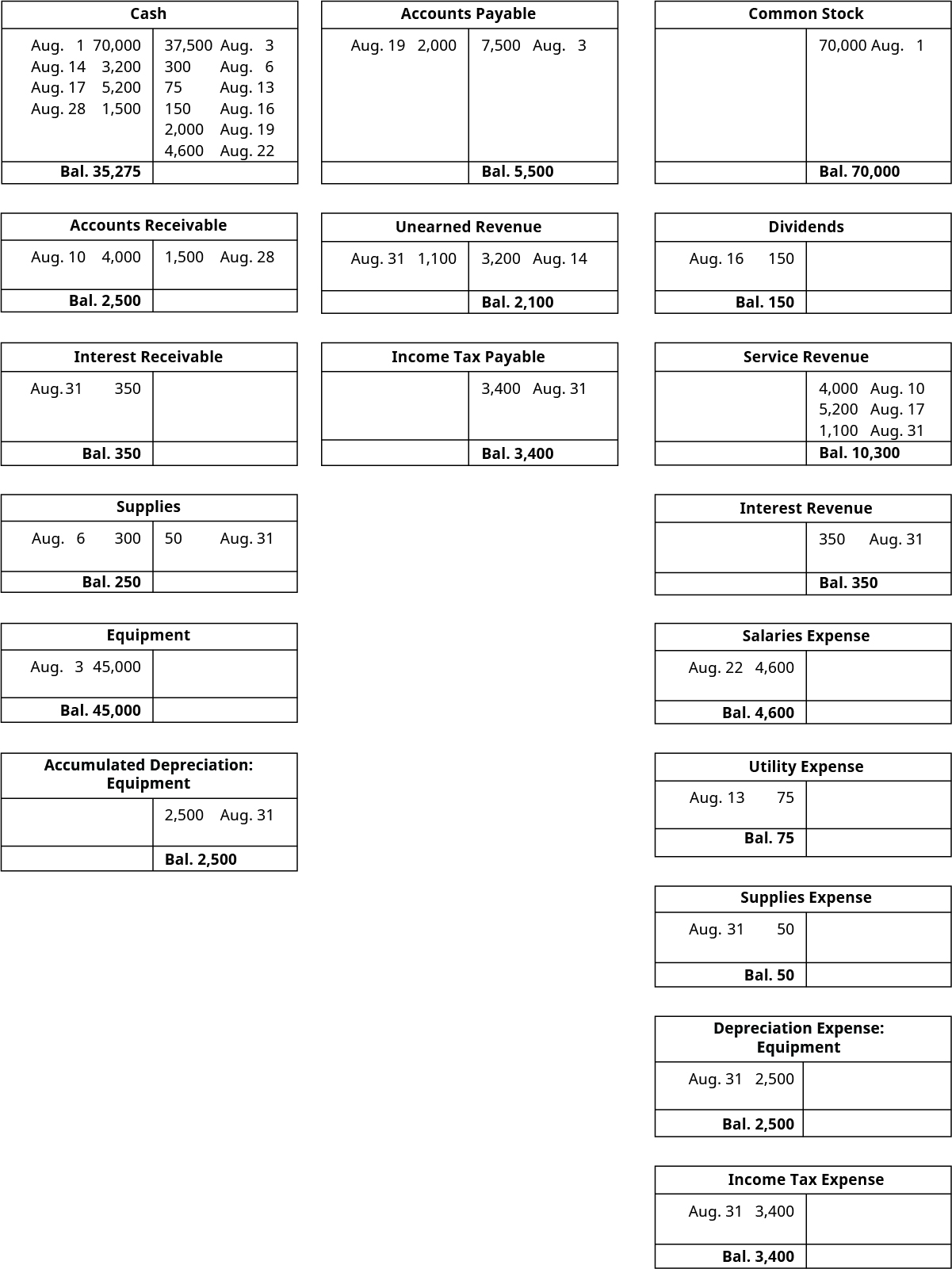

Once all journal entries have been created, the next step in the accounting cycle is to post journal information to the ledger. The ledger is visually represented by T-accounts. Cliff will go through each transaction and transfer the account information into the debit or credit side of that ledger account. Any account that has more than one transaction needs to have a final balance calculated. This happens by taking the difference between the debits and credits in an account.

Clip’em Cliff’s ledger represented by T-accounts is presented in (Figure).

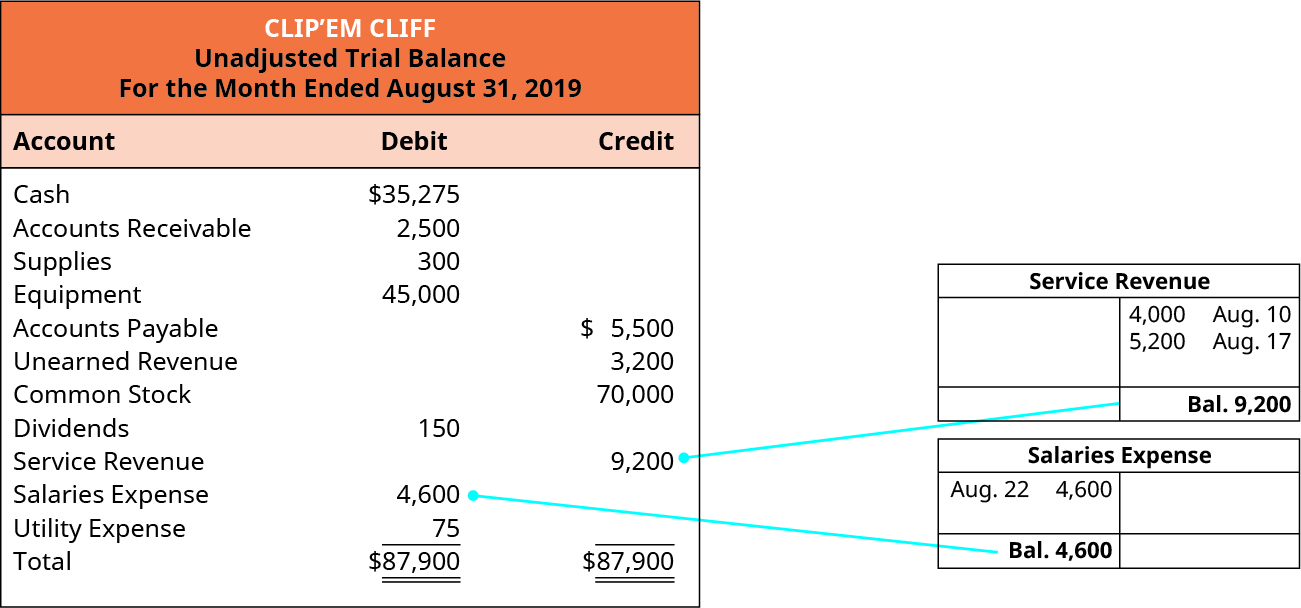

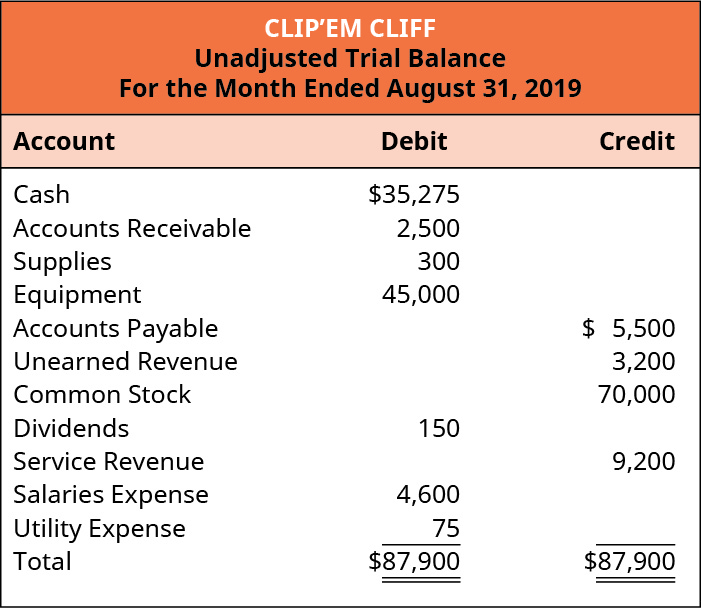

You will notice that the sum of the asset account balances in Cliff’s ledger equals the sum of the liability and equity account balances at $83,075. The final debit or credit balance in each account is transferred to the unadjusted trial balance in the corresponding debit or credit column as illustrated in (Figure).

Once all of the account balances are transferred to the correct columns, each column is totaled. The total in the debit column must match the total in the credit column to remain balanced. The unadjusted trial balance for Clip’em Cliff appears in (Figure).

The unadjusted trial balance shows a debit and credit balance of $87,900. Remember, the unadjusted trial balance is prepared before any period-end adjustments are made.

On August 31, Cliff has the transactions shown in (Figure) requiring adjustment.

| August 31 Transactions | |

|---|---|

| Date | Transaction |

| Aug. 31 | Cliff took an inventory of supplies and discovered that $250 of supplies remain unused at the end of the month. |

| Aug. 31 | The equipment purchased on August 3 depreciated $2,500 during the month of August. |

| Aug. 31 | Clip’em Cliff performed $1,100 of services during August for the customer from the August 14 transaction. |

| Aug. 31 | Reviewing the company bank statement, Clip’em Cliff discovers $350 of interest earned during the month of August that was previously uncollected and unrecorded. As a new customer for the bank, the interest was paid by a bank that offered an above-market-average interest rate. |

| Aug. 31 | Unpaid and previously unrecorded income taxes for the month are $3,400. The tax payment was to cover his federal quarterly estimated income taxes. He lives in a state that does not have an individual income tax |

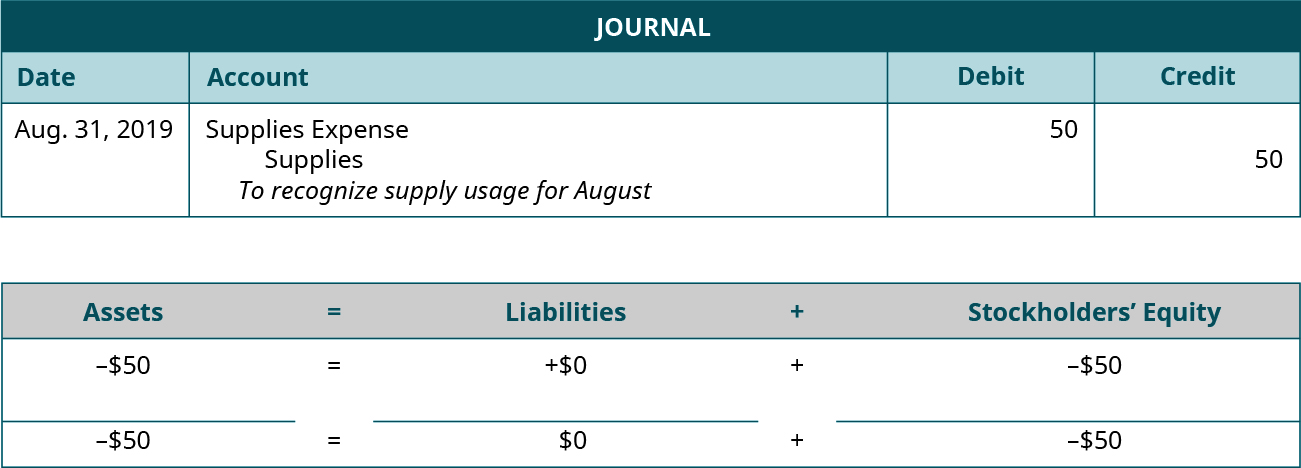

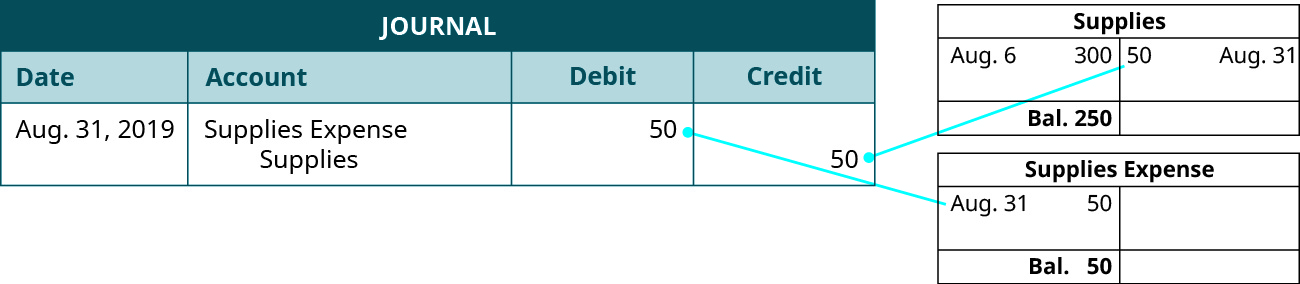

Adjusting Transaction 1: Cliff took an inventory of supplies and discovered that $250 of supplies remain unused at the end of the month.

Analysis:

- $250 of supplies remain at the end of August. The company began the month with $300 worth of supplies. Therefore, $50 of supplies were used during the month and must be recorded (300 – 250). Supplies is an asset that is decreasing (credit).

- Supplies is a type of prepaid expense, that when used, becomes an expense. Supplies Expense would increase (debit) for the $50 of supplies used during August.

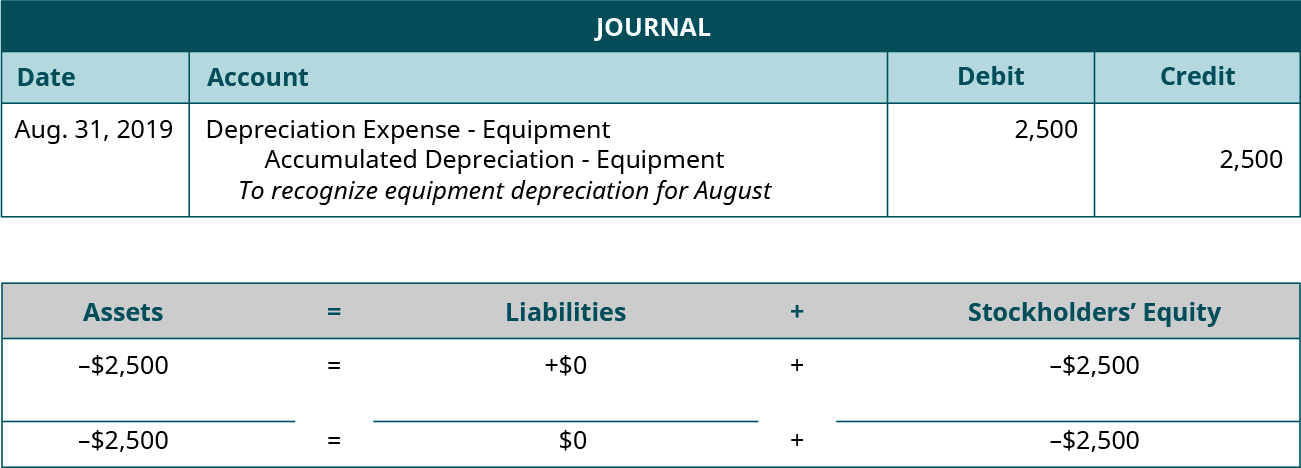

Adjusting Transaction 2: The equipment purchased on August 3 depreciated $2,500 during the month of August.

Analysis:

- Equipment cost of $2,500 was allocated during August. This depreciation will affect the Accumulated Depreciation–Equipment account and the Depreciation Expense–Equipment account. While we are not doing depreciation calculations here, you will come across more complex calculations, such as depreciation in Long-Term Assets.

- Accumulated Depreciation–Equipment is a contra asset account (contrary to Equipment) and increases (credit) for $2,500.

- Depreciation Expense–Equipment is an expense account that is increasing (debit) for $2,500.

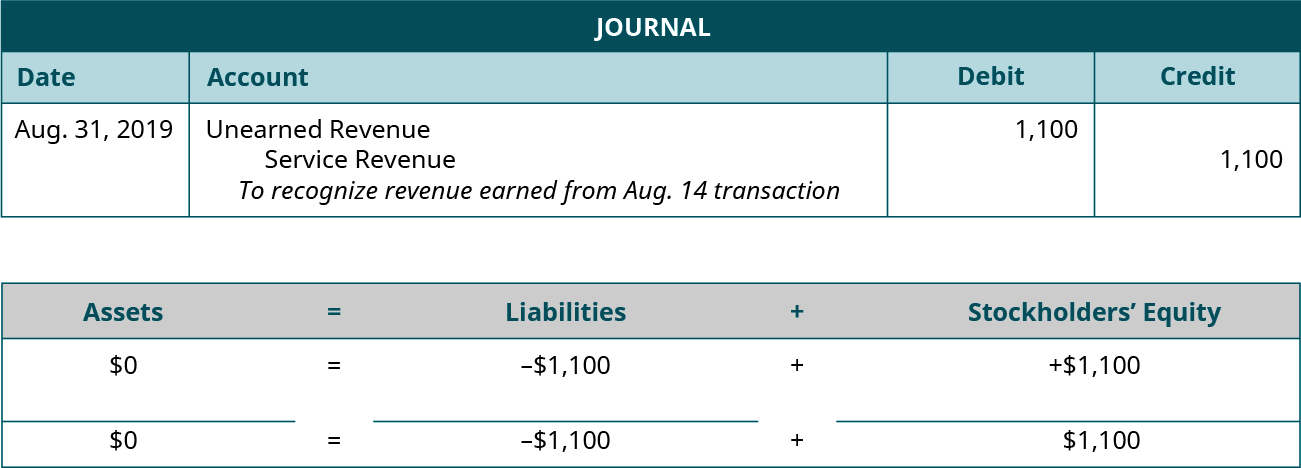

Adjusting Transaction 3: Clip’em Cliff performed $1,100 of services during August for the customer from the August 14 transaction.

Analysis:

- The customer from the August 14 transaction gave the company $3,200 in advanced payment for services. By the end of August the company had earned $1,100 of the advanced payment. This means that the company still has yet to provide $2,100 in services to that customer.

- Since some of the unearned revenue is now earned, Unearned Revenue would decrease. Unearned Revenue is a liability account and decreases on the debit side.

- The company can now recognize the $1,100 as earned revenue. Service Revenue increases (credit) for $1,100.

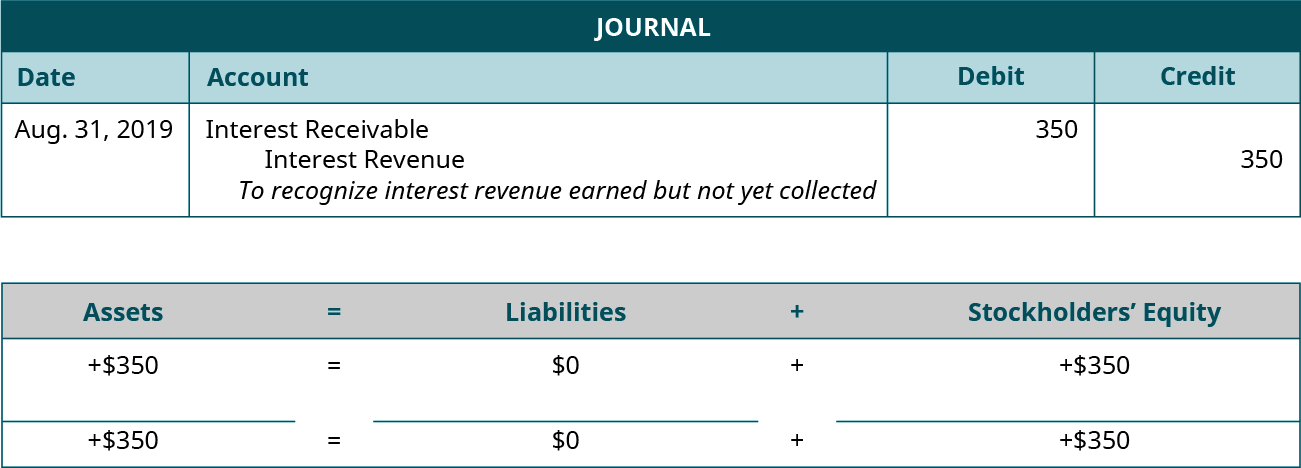

Adjusting Transaction 4: Reviewing the company bank statement, Clip’em Cliff identifies $350 of interest earned during the month of August that was previously unrecorded.

Analysis:

- Interest is revenue for the company on money kept in a money market account at the bank. The company only sees the bank statement at the end of the month and needs to record as received interest revenue reflected on the bank statement.

- Interest Revenue is a revenue account that increases (credit) for $350.

- Since Clip’em Cliff has yet to collect this interest revenue, it is considered a receivable. Interest Receivable increases (debit) for $350.

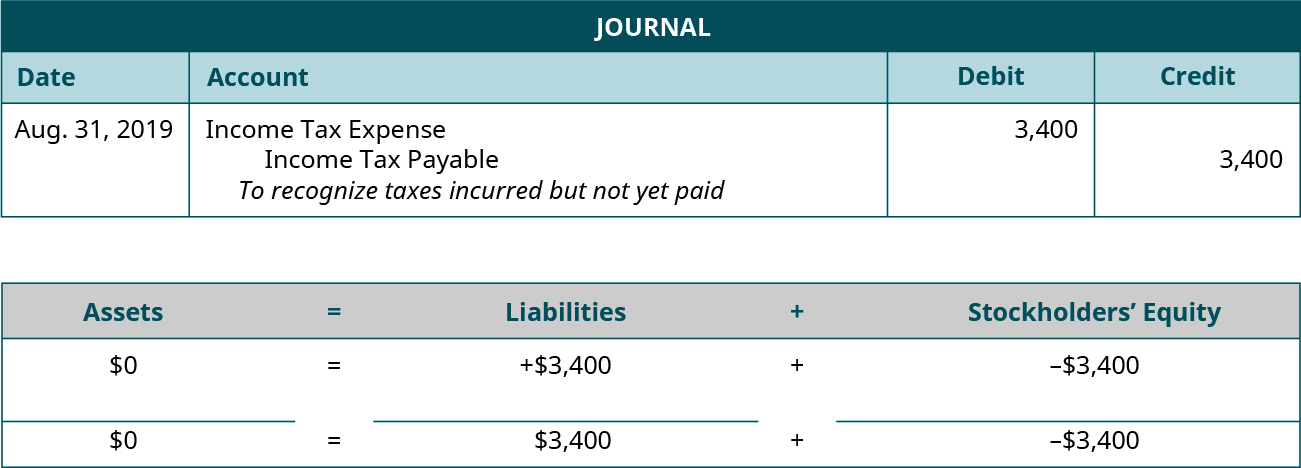

Adjusting Transaction 5: Unpaid and previously unrecorded income taxes for the month are $3,400.

Analysis:

- Income taxes are an expense to the business that accumulate during the period but are only paid at predetermined times throughout the year. This period did not require payment but did accumulate income tax.

- Income Tax Expense is an expense account that negatively affects equity. Income Tax Expense increases on the debit side.

- The company owes the tax money but has not yet paid, signaling a liability. Income Tax Payable is a liability that is increasing on the credit side.

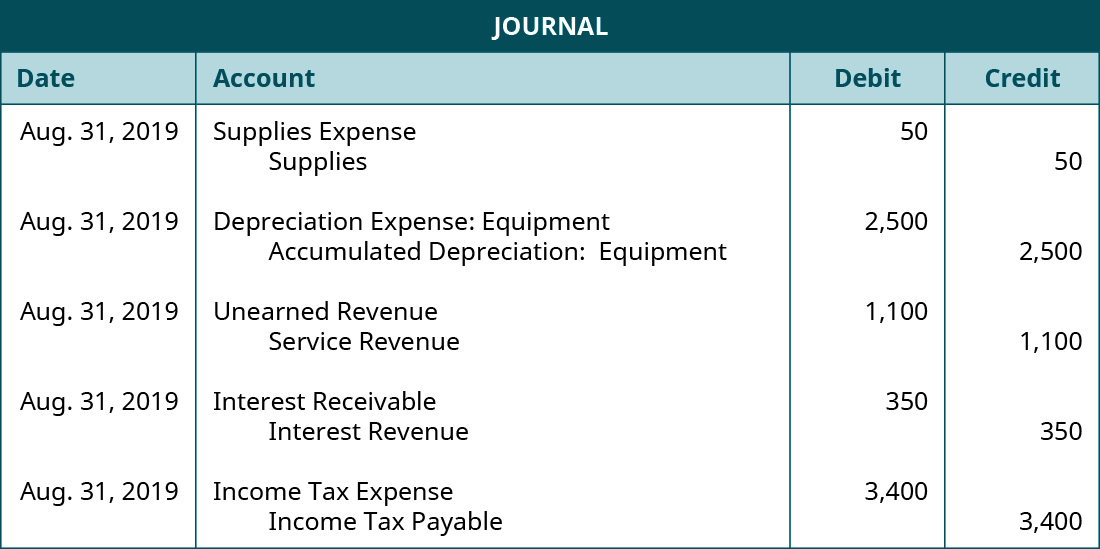

The summary of adjusting journal entries for Clip’em Cliff is presented in (Figure).

Now that all of the adjusting entries are journalized, they must be posted to the ledger. Posting adjusting entries is the same process as posting the general journal entries. Each journalized account figure will transfer to the corresponding ledger account on either the debit or credit side as illustrated in (Figure).

We would normally use a general ledger, but for illustrative purposes, we are using T-accounts to represent the ledgers. The T-accounts after the adjusting entries are posted are presented in (Figure).

You will notice that the sum of the asset account balances equals the sum of the liability and equity account balances at $80,875. The final debit or credit balance in each account is transferred to the adjusted trial balance, the same way the general ledger transferred to the unadjusted trial balance.

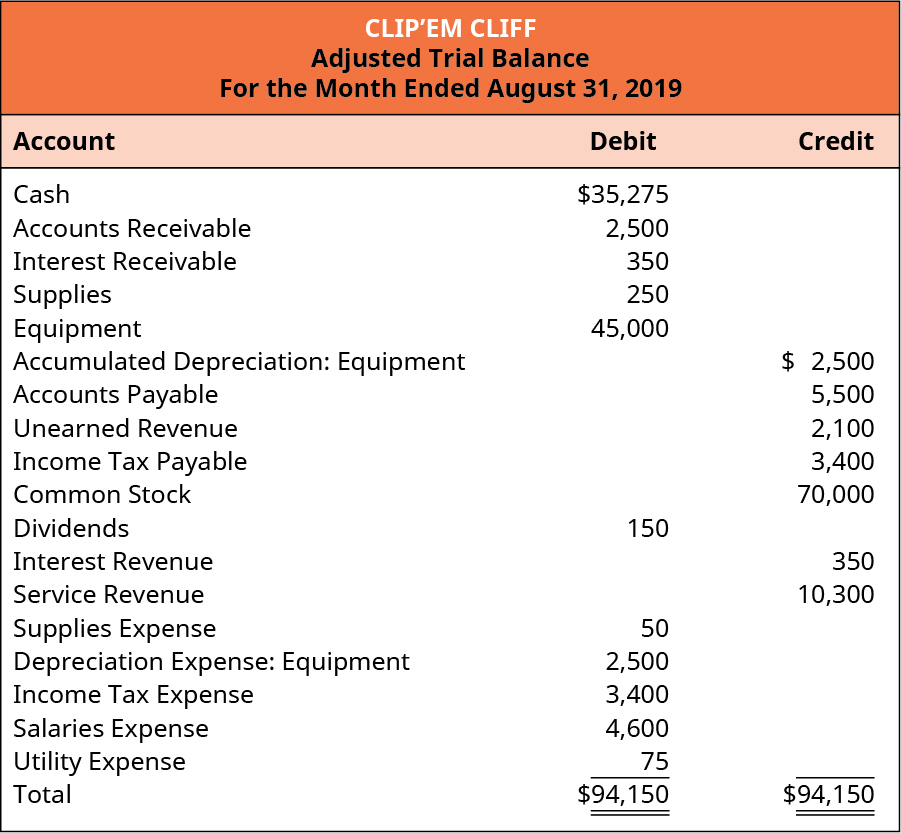

The next step in the cycle is to prepare the adjusted trial balance. Clip’em Cliff’s adjusted trial balance is shown in (Figure).

The adjusted trial balance shows a debit and credit balance of $94,150. Once the adjusted trial balance is prepared, Cliff can prepare his financial statements (step 7 in the cycle). We only prepare the income statement, statement of retained earnings, and the balance sheet. The statement of cash flows is discussed in detail in Statement of Cash Flows.

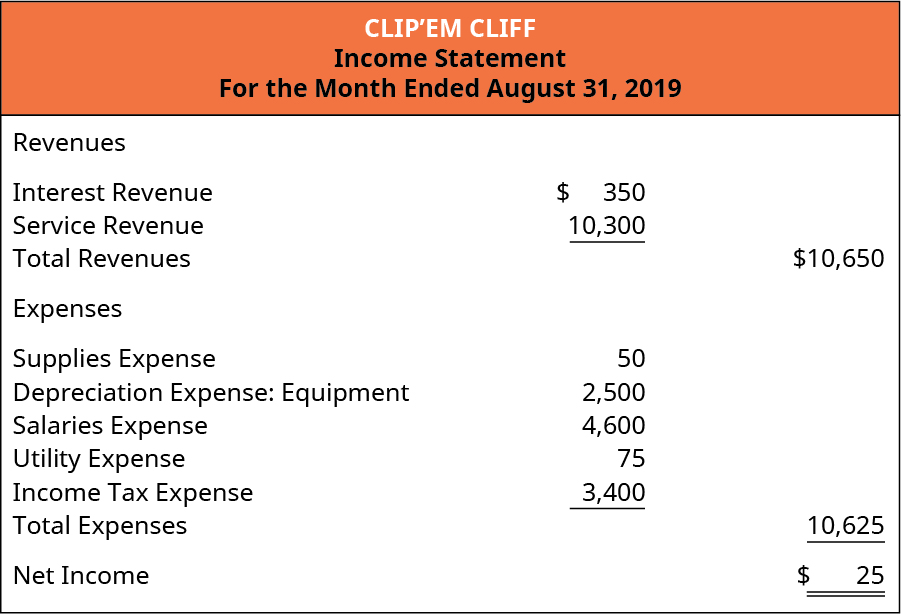

To prepare your financial statements, you want to work with your adjusted trial balance.

Remember, revenues and expenses go on an income statement. Dividends, net income (loss), and retained earnings balances go on the statement of retained earnings. On a balance sheet you find assets, contra assets, liabilities, and stockholders’ equity accounts.

The income statement for Clip’em Cliff is shown in (Figure).

Note that expenses were only $25 less than revenues. For the first month of operations, Cliff welcomes any income. Cliff will want to increase income in the next period to show growth for investors and lenders.

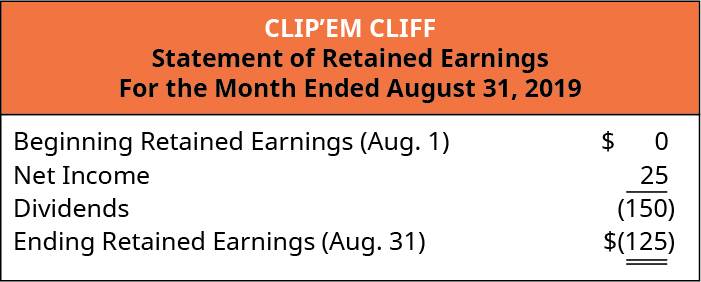

Next, Cliff prepares the following statement of retained earnings ((Figure)).

The beginning retained earnings balance is zero because Cliff just began operations and does not have a balance to carry over to a future period. The ending retained earnings balance is –$125. You probably never want to have a negative value on your retained earnings statement, but this situation is not totally unusual for an organization in its initial operations. Cliff will want to improve this outcome going forward. It might make sense for Cliff to not pay dividends until he increases his net income.

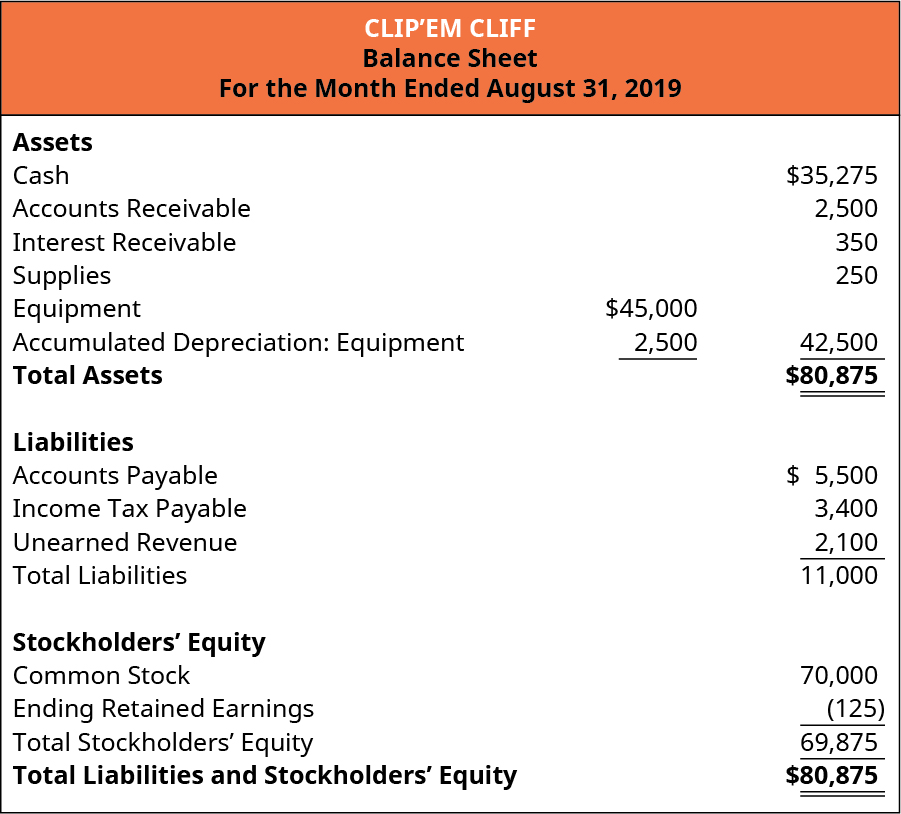

Cliff then prepares the balance sheet for Clip’em Cliff as shown in (Figure).

The balance sheet shows total assets of $80,875, which equals total liabilities and equity. Now that the financial statements are complete, Cliff will go to the next step in the accounting cycle, preparing and posting closing entries. To do this, Cliff needs his adjusted trial balance information.

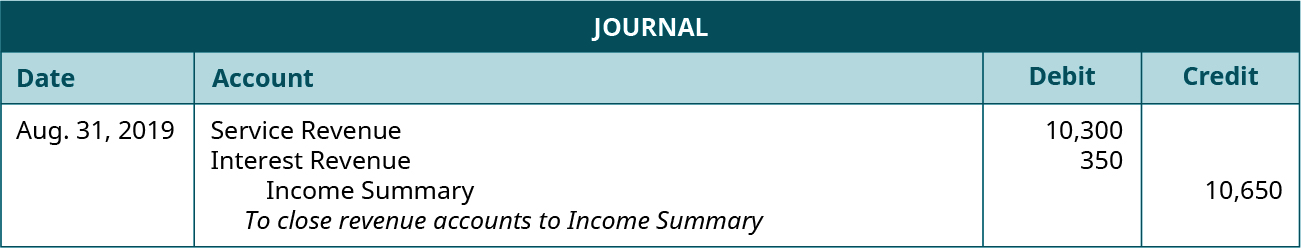

Cliff will only close temporary accounts, which include revenues, expenses, income summary, and dividends. The first entry closes revenue accounts to income summary. To close revenues, Cliff will debit revenue accounts and credit income summary.

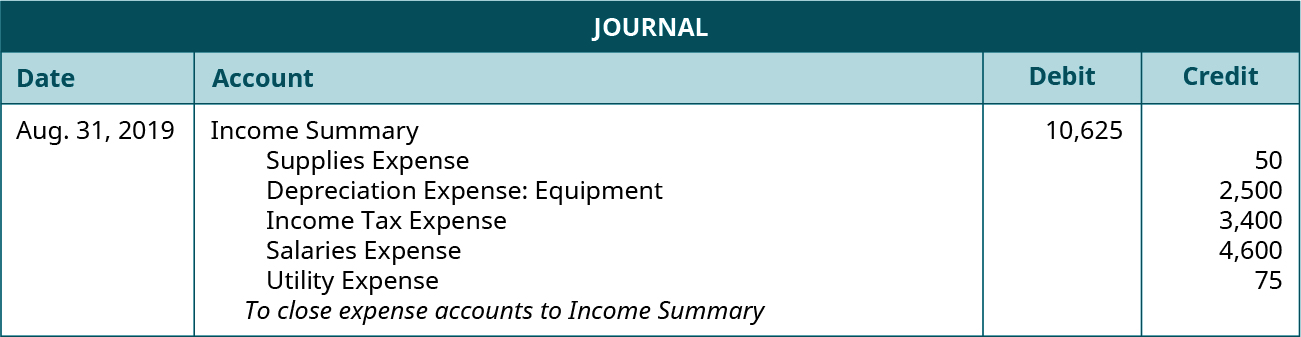

The second entry closes expense accounts to income summary. To close expenses, Cliff will credit expense accounts and debit income summary.

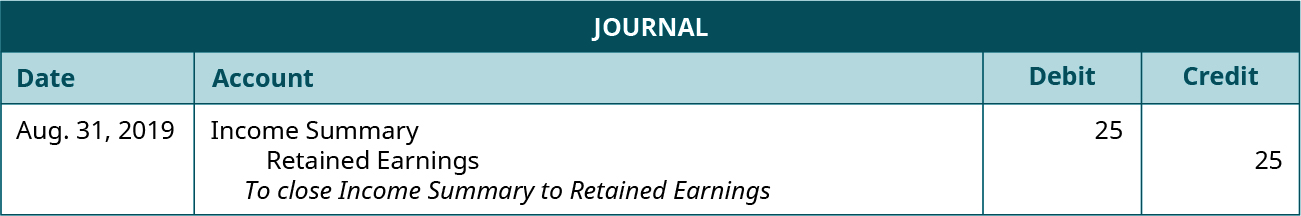

The third entry closes income summary to retained earnings. To find the balance, take the difference between the income summary amount in the first and second entries (10,650 – 10,625). To close income summary, Cliff would debit Income Summary and credit Retained Earnings.

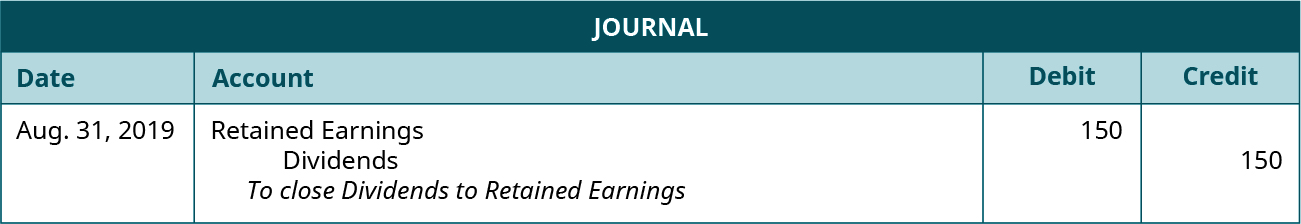

The fourth closing entry closes dividends to retained earnings. To close dividends, Cliff will credit Dividends, and debit Retained Earnings.

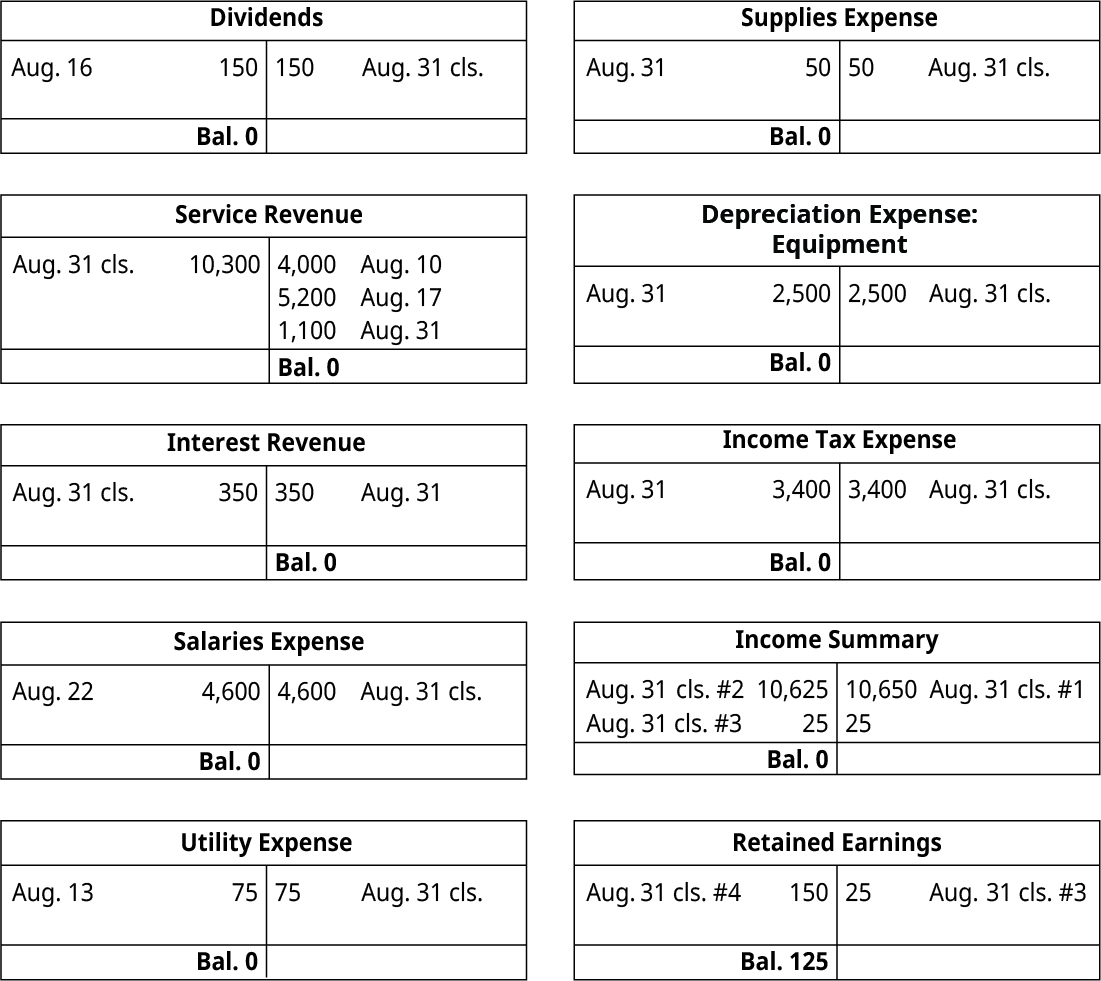

Once all of the closing entries are journalized, Cliff will post this information to the ledger. The closed accounts with their final balances, as well as Retained Earnings, are presented in (Figure).

Now that the temporary accounts are closed, they are ready for accumulation in the next period.

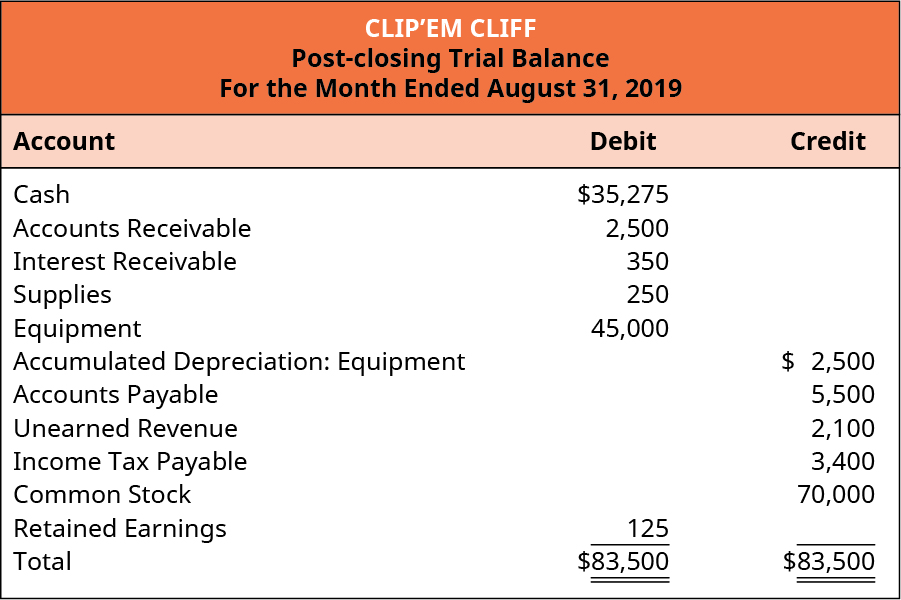

The last step for the month of August is step 9, preparing the post-closing trial balance. The post-closing trial balance should only contain permanent account information. No temporary accounts should appear on this trial balance. Clip’em Cliff’s post-closing trial balance is presented in (Figure).

At this point, Cliff has completed the accounting cycle for August. He is now ready to begin the process again for September, and future periods.

CONCEPTS IN PRACTICE

One step in the accounting cycle that we did not cover is reversing entries. Reversing entries can be made at the beginning of a new period to certain accruals. The company will reverse adjusting entries made in the prior period to the revenue and expense accruals.

It can be difficult to keep track of accruals from prior periods, as support documentation may not be readily available in current or future periods. This requires an accountant to remember when these accruals came from. By reversing these accruals, there is a reduced risk for counting revenues and expenses twice. The support documentation received in the current or future period for an accrual will be easier to match to prior revenues and expenses with the reversal.

LINK TO LEARNING

THINK IT THROUGH

You own a landscaping business that has just begun operations. You made several expensive equipment purchases in your first month to get your business started. These purchases very much reduced your cash-on-hand, and in turn your liquidity suffered in the following months with a low working capital and current ratio.

Your business is now in its eighth month of operation, and while you are starting to see a growth in sales, you are not seeing a significant change in your working capital or current ratio from the low numbers in your early months. What could you attribute to this stagnancy in liquidity? Is there anything you can do as a business owner to better these liquidity measurements? What will happen if you cannot change your liquidity or it gets worse?

KEY TAKEAWAYS

Key Concepts and Summary

- The comprehensive accounting cycle is the process in which transactions are recorded in the accounting records and are ultimately reflected in the ending period balances on the financial statements.

- Comprehensive accounting cycle for a business: A service business is taken through the comprehensive accounting cycle, starting with the formation of the entity, recording all necessary journal entries for its transactions, making all required adjusting and closing journal entries, and culminating in the preparation of all requisite financial statements.